Managing your finances can be a bit like solving a puzzle. You've got pieces of income and expenses that need to fit together perfectly. But what if there was a financial strategy that made this puzzle easier to solve?

Welcome to the world of zero-based budgeting, a method that's gained popularity for its effectiveness in ensuring every dollar has a purpose.

In this article, we'll dive into the concept of zero-based budgeting, explore why we believe it's the most effective budgeting approach, provide real-life examples, guide you on creating your own zero-based budget, and discuss its advantages and disadvantages.

If you're struggling with repaying your student loan debt, then the zero-based budget just might be what you're looking for!

What is Zero-Based Budgeting?

Zero-based budgeting is a budgeting strategy where your income minus your expenses equals zero. Sounds simple, right? But it's this simplicity that makes it so effective.

Every dollar you earn has a job, a purpose, a goal. There's no room for mindless spending on daily lattes or impulse purchases. This method ensures that you're in control of your money, rather than your money controlling you.

A quick note: Zero-based budgeting doesn't mean you should or have to have zero dollars left in your bank account. It just means that, when you subtract all your planned expenses from your income, the result should be zero.

It's always wise to keep a small buffer as a financial safety net. We're all human, and we might forget about a subscription or an emergency might pop up. Keep whatever buffer you think is necessary - for you. This could be $100, $300, $500, you decide.

Why is Zero-Based Budgeting The Most Effective?

Here are a few reasons why zero-based budgeting is the most effective budgeting method:

Total Financial Awareness

Zero-based budgeting forces you to be acutely aware of where every dollar is going. This heightened awareness helps you spot unnecessary expenses and focus on your financial goals.

Prioritizes Financial Goals

With every dollar assigned a specific purpose, you prioritize your financial goals. Whether it's paying off student loans, saving for a vacation, or building an emergency fund, a zero-based budget ensures you're actively working towards your objectives.

Eliminates Mindless Spending

One of the most significant advantages of this method is that it eliminates frivolous spending. You'll think twice before making impulse purchases because they need to fit into your budget.

I remember when I first graduated, I was still in college mode and spending basically whatever I wanted at the bar or on random trips. It felt good to be making money at my first "real" job.

Looking back, all of that money could have been put to better use and helping me pay down my student loan debt.

Zero-Based Budgeting Example

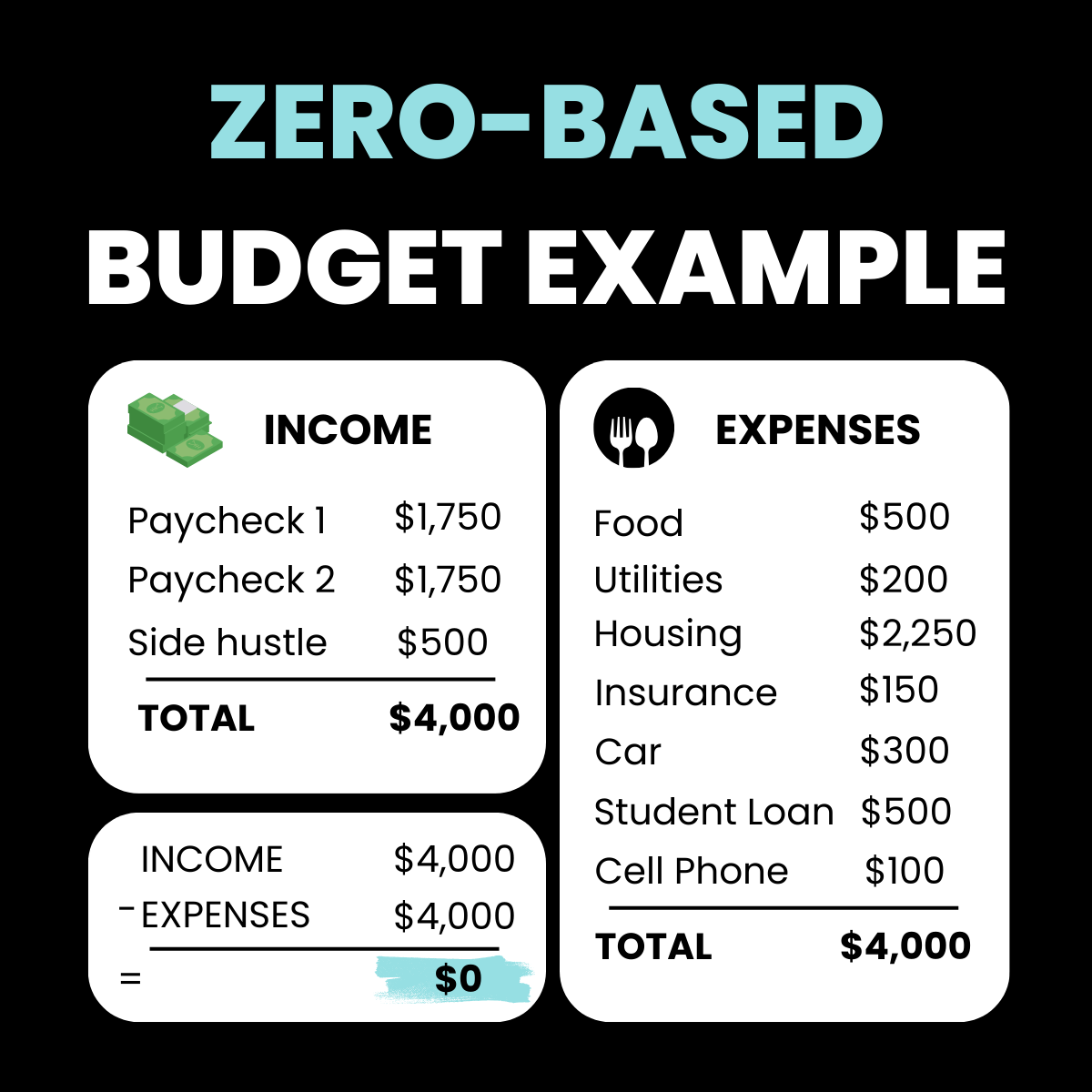

Let's break down zero-based budgeting with an example:

When we add up all the expenses, it equals the total income of $4,000. Every dollar is accounted for, leaving you in complete control of your finances.

How To Make A Zero-Based Budget

Creating a zero-based budget involves a few simple steps:

Calculate Your Income

Determine your monthly income, considering all sources. If you start to notice you need to increase your income to get out of debt sooner, consider checking out potential side hustles.

List Your Expenses

Make a list of all your expenses, including fixed costs like rent and variable costs like groceries.

Assign Every Dollar

Allocate your income to cover each expense, savings, and any financial goals you have.

Track Your Spending

Throughout the month, track your expenses to ensure they align with your budget.

Adjust as Needed

Be prepared to adjust your budget as circumstances change. If you've paid off your student loan debt, then what's your next goal?

Advantages of Zero-Based Budgeting

Zero-based budgeting offers numerous advantages, including:

Enhanced Financial Discipline

Zero-based budgeting promotes enhanced financial discipline by requiring you to allocate every dollar to a specific purpose. This discipline stems from the very essence of the budgeting method: ensuring that every dollar has a job.

It compels you to think critically about your spending, prioritize your financial goals, and make conscious decisions about where your money goes.

This heightened discipline translates into greater control over impulsive spending. It encourages you to stick to your budget and avoid frivolous purchases. Over time, practicing financial discipline can lead to more positive financial decisions, fostering a healthier financial lifestyle.

Improved Savings Habits

Zero-based budgeting can be a game-changer for your savings habits. By explicitly setting aside funds for savings in your budget, you're taking the proactive step of securing your financial future. This budgeting method encourages you to consider saving as a non-negotiable expense, just like your rent or groceries.

As you consistently adhere to your zero-based budget, you'll find that your savings start to grow steadily. Over time, this can lead to the development of a robust savings habit. Whether you're saving for emergencies, a dream vacation, or long-term investments, a zero-based budget can help you make progress and achieve your saving goals.

Efficient Debt Repayment

Zero-based budgeting is particularly effective when it comes to debt repayment, especially for those dealing with student loans or other outstanding obligations. The method ensures that a portion of your income is dedicated to debt payments. This allocation may include more than the minimum required payment, enabling you to expedite the repayment process.

By making debt repayment a non-negotiable component of your budget, you consistently chip away at your outstanding balances. This approach can lead to substantial savings on interest payments and an earlier debt-free status.

Clear Financial Prioritization

One of the standout advantages of zero-based budgeting is the explicit prioritization it encourages. Your budget becomes a reflection of your financial goals and values. It compels you to identify and rank these goals, allocating resources accordingly.

This clarity of financial prioritization ensures that you're actively working towards your most critical objectives. As a result, you're less likely to lose sight of your goals or become distracted by unnecessary expenses. Your financial resources align with your aspirations, making it easier to achieve them.

Reduced Stress About Money

The comprehensive nature of zero-based budgeting can significantly reduce stress related to money. It removes uncertainty about where your income goes and ensures that you have accounted for all expenses.

This can bring you peace of mind, as you're less likely to encounter financial surprises or scramble to cover unexpected costs.

Disadvantages of Zero-Based Budgeting

While we believe this method is the most effective, it may not suit everyone. Some potential disadvantages to think about:

Time-Consuming

Creating and tracking a zero-based budget can be time-consuming. Income and expenses can change over time so it's important to keep your budget up to date.

Rigid for Some

It might feel too restrictive for those who prefer a more flexible option. It leaves little room for spontaneous spending and may not align with those who prefer a more relaxed approach to budgeting.

Requires Discipline

Sticking to a zero-based budget requires discipline and commitment. This means resisting the temptation of overspending or diverting funds from one category to another without a valid reason.

Why Is Zero-Based Budgeting Important

If you're dealing with student loans, zero-based budgeting is essential. It ensures that your finances align with your goal of paying off your student loan debt.

By assigning every dollar a purpose, you can allocate funds to your student loan payments, make consistent progress, and ultimately become debt-free more sooner.

In our free budget template, you can make edits how you see fit. We even have a section that highlights if you have any money left over, and how to allocate that towards your student loans.

Using a Zero-Based Budget For Your Student Loans

To make the most of zero-based budgeting for your student loans:

Prioritize Loan Payments

Allocate a significant portion of your budget to student loan payments.

Cut Unnecessary Expenses

Identify and eliminate unnecessary spending to free up more money for your loans. Look at any subscriptions you may have that you don't regularly use or need.

What about your phone bill or calling your internet service provider? See what you can do to lower your monthly bills, and put the difference towards your debt.

Set Clear Goals

Establish specific goals for paying off your loans, such as a target payoff date or making payments twice a month to stay ahead of interest charges.

Consider searching our database to find a job that helps you pay down your student debt.

A company providing student loan repayment of $100 per month to their employees, can help you pay off your loan almost 3 years earlier!

Monitor Progress

Regularly track your financial progress and make adjustments as needed. In our budget template we have a graph included which gives you a nice visual (if you're into that sort of thing) to see how much of a dent you're making.

Final Thoughts on Zero-Based Budgeting

Zero-based budgeting is a powerful tool for taking control of your finances, and it's particularly effective for managing student loan debt. By ensuring every dollar has a purpose, you can accelerate your journey towards financial freedom.

Whether your goal is to pay off student loans, save for a major purchase, or build an emergency fund, a zero-based budget can help you achieve it.

Remember, the key to financial success is not just earning money but managing it wisely, and zero-based budgeting is a valuable approach in that journey.