The student loan payment pause has been extended through August 31, 2022. The extension provides more time for borrowers to plan for the resumption of payments, but it also provides more time for the Biden administration to come up with some sort of resolution for the student debt crisis.

When I started this company, one of my goals was to connect those who have student loan debt to companies that provide student loan repayment benefits. On this journey, I've been fortunate enough to cross paths with some great companies that are doing some amazing work in regard to the student debt crisis.

One of these companies, and who you will be reading more about today, is called Dolr.

What is Dolr?

Dolr is a student loan repayment platform that accelerates their members to $0 student loan debt by getting more cash for their payments. The company was founded in 2019 and enables employers to invest in their people by helping them get their student loan balance to $0.

From the above article, founder Naveed Iqbal says, "No generation knows more about what they want. No one is more aware of their finances than Millennials and Gen Z. But they are putting a lot of emphasis on living their lives. They know exactly what they want. This is the person we are serving. Dolr exists to accelerate these busy generations to $0 student debt with their money, their employer's money, and money from the apps they use."

How does Dolr help get your student loan balance to $0?

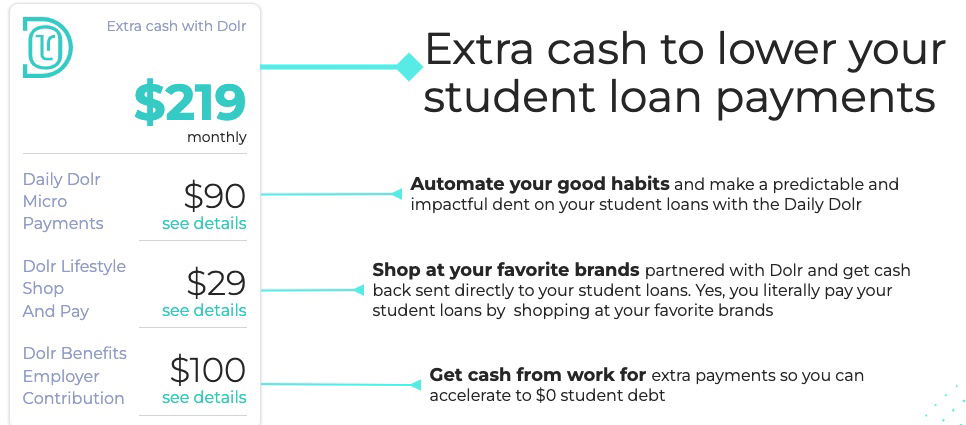

Dolr helps you get extra cash so you can make more payments towards your student loans and lose that balance once and for all.

They offer a micro payment option to help you with setting up good habits everyday. The company partners with your favorite brands so you can get cash back towards your student loans for shopping at your favorite stores. Dolr also helps to get cash from your employer if they have a student loan repayment benefit set up. If your company does not have this benefit, here are some tips on how to ask your employer for a repayment assistance program.

It takes less than a minute to sign up and link your student loan accounts on the Dolr platform. Once signed up, the platform will analyze your student loans and then make personalized recommendations based on your specific situation.

How does Dolr help employers with student loan repayment benefits?

Dolr helps employers recruit, retain, and engage their teams with one of the most desired employee benefits in the U.S., student loan repayment.

89% of people would take a job offering student loan benefits vs. another. 94% of people would stay at a job offering student loan benefits vs. another. 85% of borrowers cite their loans as a major source of financial stress.

See what others are saying about working with Dolr:

Heard enough? Sign up here and start offering student loan repayment benefits for your employees!

Wrap-Up

Dolr understands you have big dreams and they want to help you achieve them by getting you to $0 in student debt. Do you want to buy your first house? Start a family? Take a vacation or retire early?

Me too!

Check out Dolr and be sure to let us know about your experience with the platform.

.png)